Unleash the power of Cross Border payments infrastructure

Our borderless solutions empower startups to enterprises globally. Effortlessly accept payments, streamline payouts, manage global expenses, automate financial tasks, and grow revenue.

Smart companies choose Verto

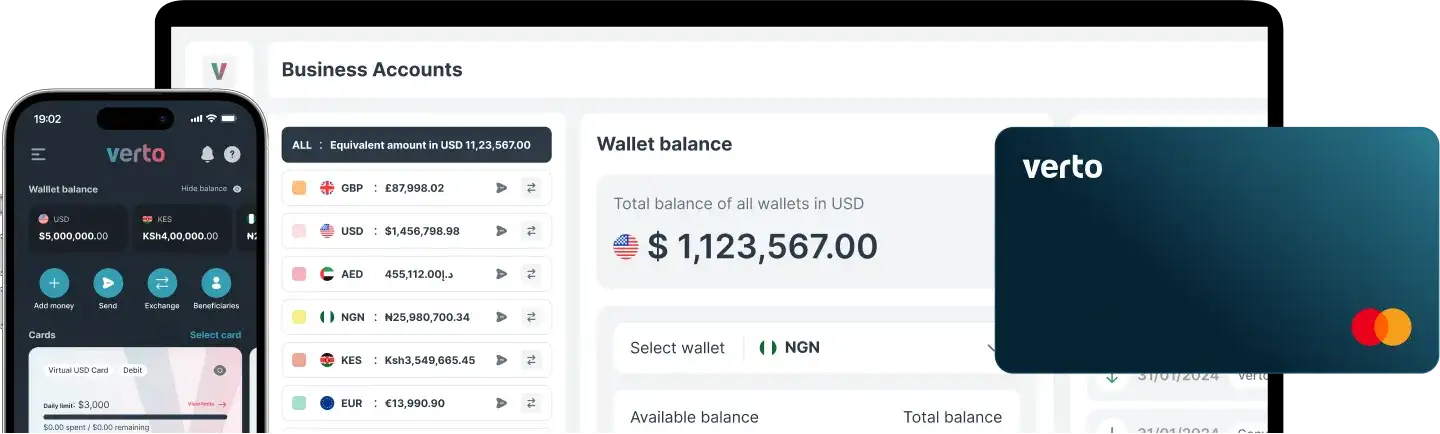

Global finances, Unified solutions

Centralise all your currency management in one place for confident financial control and streamlined operations.

Your gateway to the global payments ecosystem

Tap into Verto's global network for fast, cost-efficient transactions. Operate locally from anywhere: set up instant local accounts, accept native currency payments, manage multi-currency funds, convert at interbank rates, and execute high-speed global transfers.

Countries from which you can accept payments

Countries where you can open accounts with local bank details

Global payments processed annually

Processing time for transaction cutdown, boosting productivity.

Reduction in cross-border payments costs, increasing profitability.

Fuel business growth at every stage with our customised financial solutions.

Startups

Get paid like a local with our local account or similarly seize international opportunities with our multi-currency global account. Simplify transactions and accelerate cash flow with payment links, fueling your growth from day one.

Mid-size companies

Elevate your operations with integrated expense management, ensuring efficiency and compliance at scale. Seamlessly manage expenses alongside your international business account and corporate card.

Enterprises

Navigate complex markets confidently with our FX & treasury management solutions, mitigating risks and optimising funds with our advanced liquidity management. Drive innovation and scalability with our core API, integrating seamlessly with your invoice payments and multi-currency wallet.

Regulated excellence

Verto upholds the highest regulatory standards globally, ensuring each transaction meets strict compliance requirements. Trust in Verto is anchored in our unwavering commitment to regulatory excellence.

Trusted by innovators and industry leaders

Security and compliance is at the heart of what we do

Verto adheres to regulations and standards that govern how personal data is collected, stored, processed, and shared. We are compliant with key regulations in every market we operate in, including GDPR and CCPA.

Verto holds an Electronic Money Institution (EMI) licence from the UK's Financial Conduct Authority, ensuring top-tier protection for customer funds. This licence mandates strict safeguarding measures to protect customer funds. We keep your money in secure, separate bank accounts, completely isolated from our business funds and inaccessible to creditors. This guarantees that your funds are always safe and available whenever you need them.